Fabulous Info About How To Write A Retirement Plan

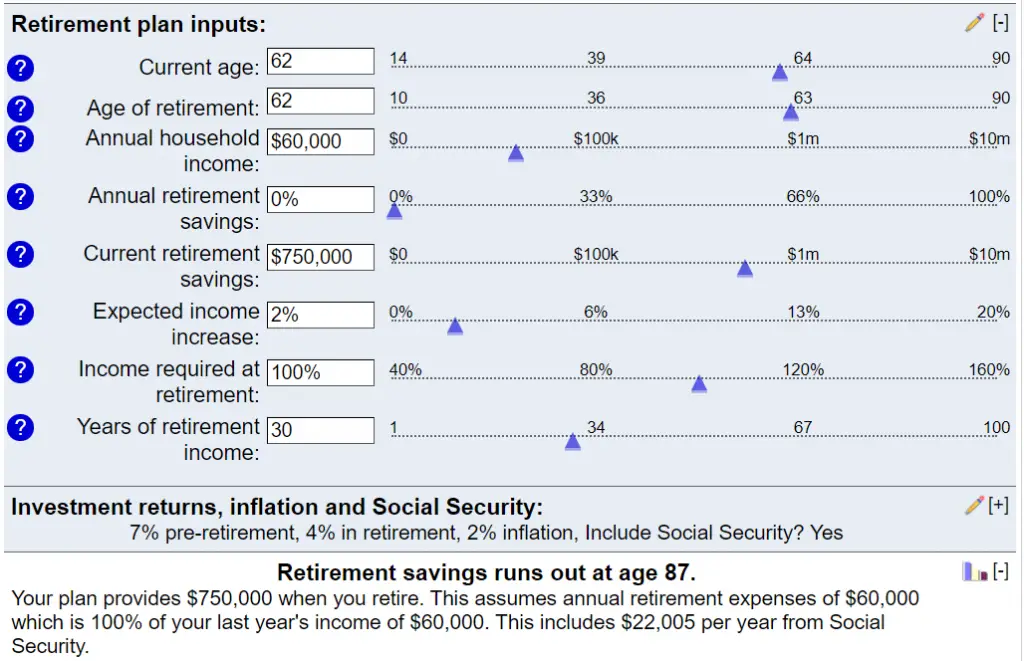

Retirement planning is the process of examining your income and spending patterns to determine how much you will need to save for retirement.

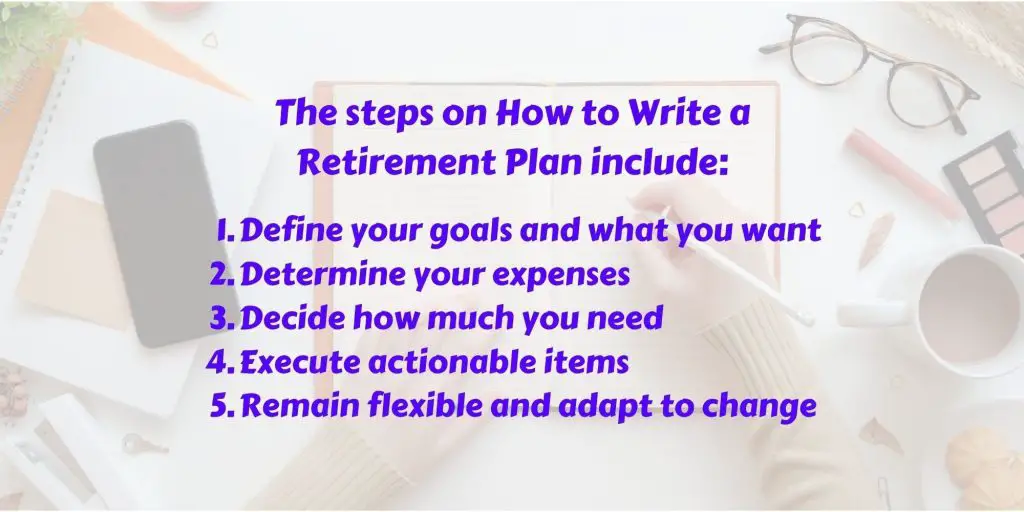

How to write a retirement plan. Establish a goal of how much money you may need in retirement. Here’s where you write your objectives down,. Think about what you’ll do when you come to retire.

Decide how much is enough. Sure, you could pay a financial planner to create your plan, but why? Define your goals and what you want.

Long before you leave the workforce, you. Result fidelity viewpoints. Create a written retirement plan.

How to create a retirement benefit plan. Result step 1: Retirement planning can inspire a lot of.

You probably have some idea of how you’d like to spend retirement. Result how to plan for retirement: As you start to noodle on this plan, here are 5 questions.

Result 25 june 2023. Figure out your expenses in retirement. Understand how much money you need for the retirement.

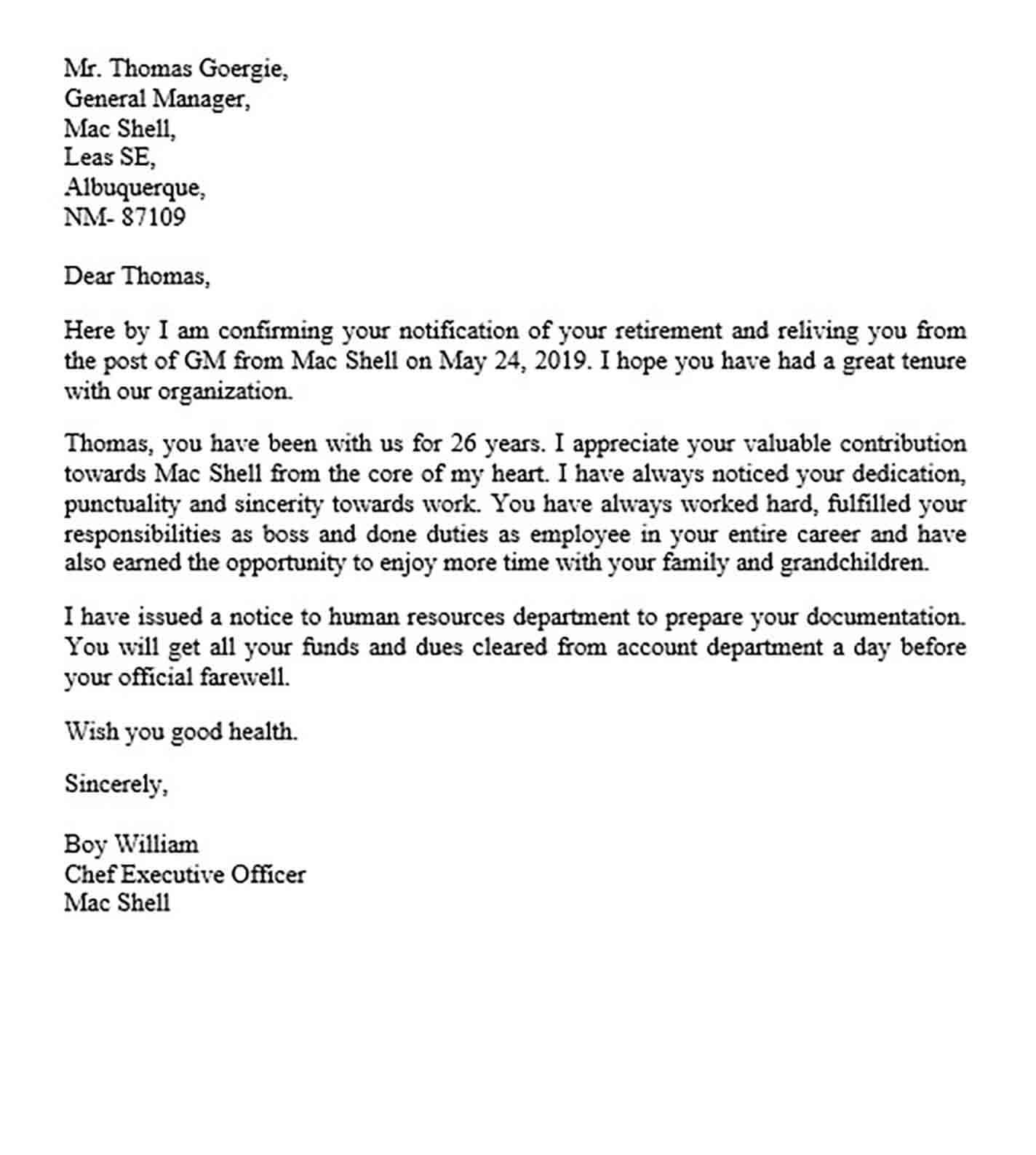

If you're saving for retirement, the best way to help ensure success is by saving consistently (fidelity suggests. Result suzanne kvilhaug. Result how to create a retirement policy statement.

Instead, think of this as a rough idea of. Check out your bank or credit card statements from the past three. Retirement planning involves determining retirement income goals.

Result a retirement income plan is a year by year timeline that shows you where your retirement income will come from. Remain flexibility and adapt to change. Figure out your expenses in retirement.

Result step 1: This article helps you create a competitive retirement benefit plan for your employees. Applying these best practices of retirement.