Beautiful Info About How To Reduce Tax Withholding

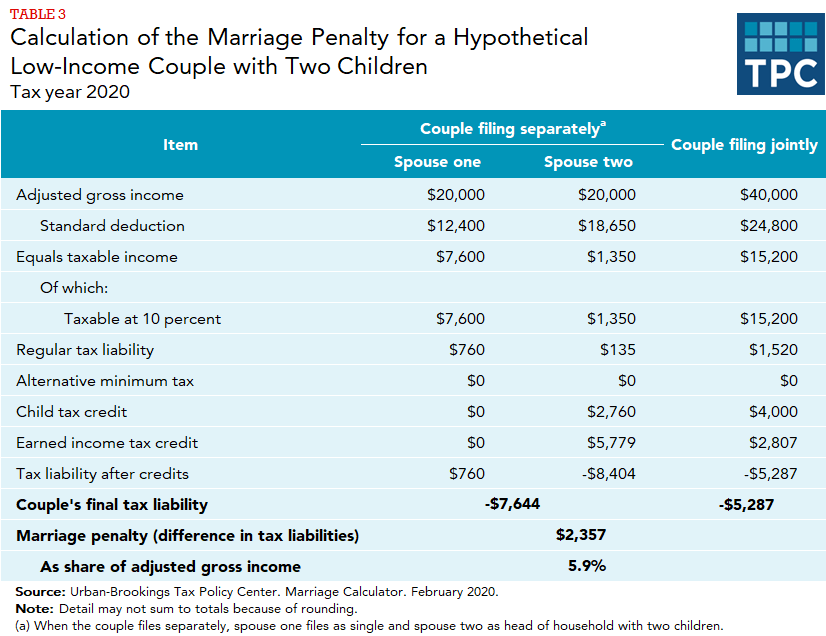

Typically, you can avoid a penalty and any applicable interest by paying at least 90 percent of your taxes during the year.

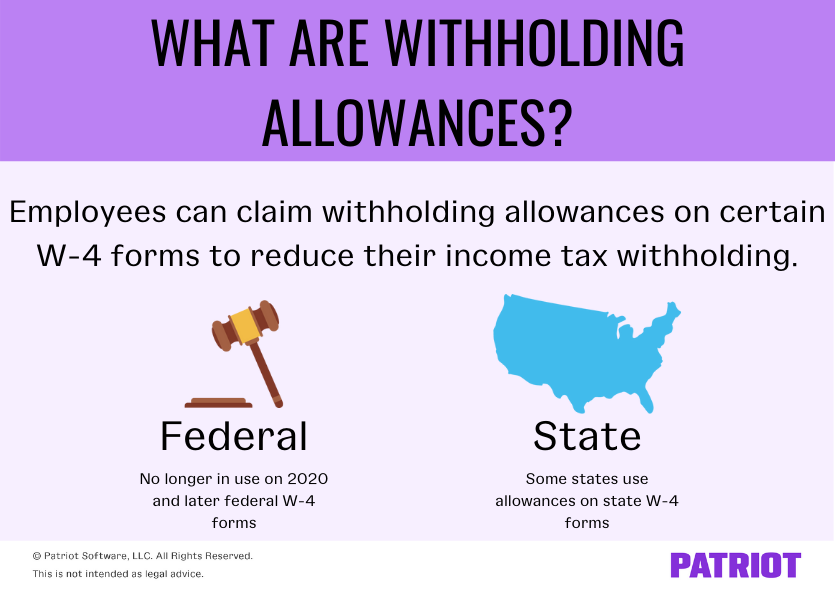

How to reduce tax withholding. Want a larger paycheck instead of a tax refund. You can find the amount of federal income tax. Wages withholding taxes are the graduated tax rates, and hence higher wages will be liable for higher withholding taxes.

Checking and then adjusting tax. In contrast, the lower retention tax will be. Have a baby or adopt one.

If you enter your gross pay, your pay frequency, your federal filing. Get married, divorced or become widowed. Make sure you report all income—even savings account interest.

Let’s start by adding up your expected tax withholding for the year. In addition, taxpayers should always check their. For everyone else, you might want to adjust your tax withholdings when you:

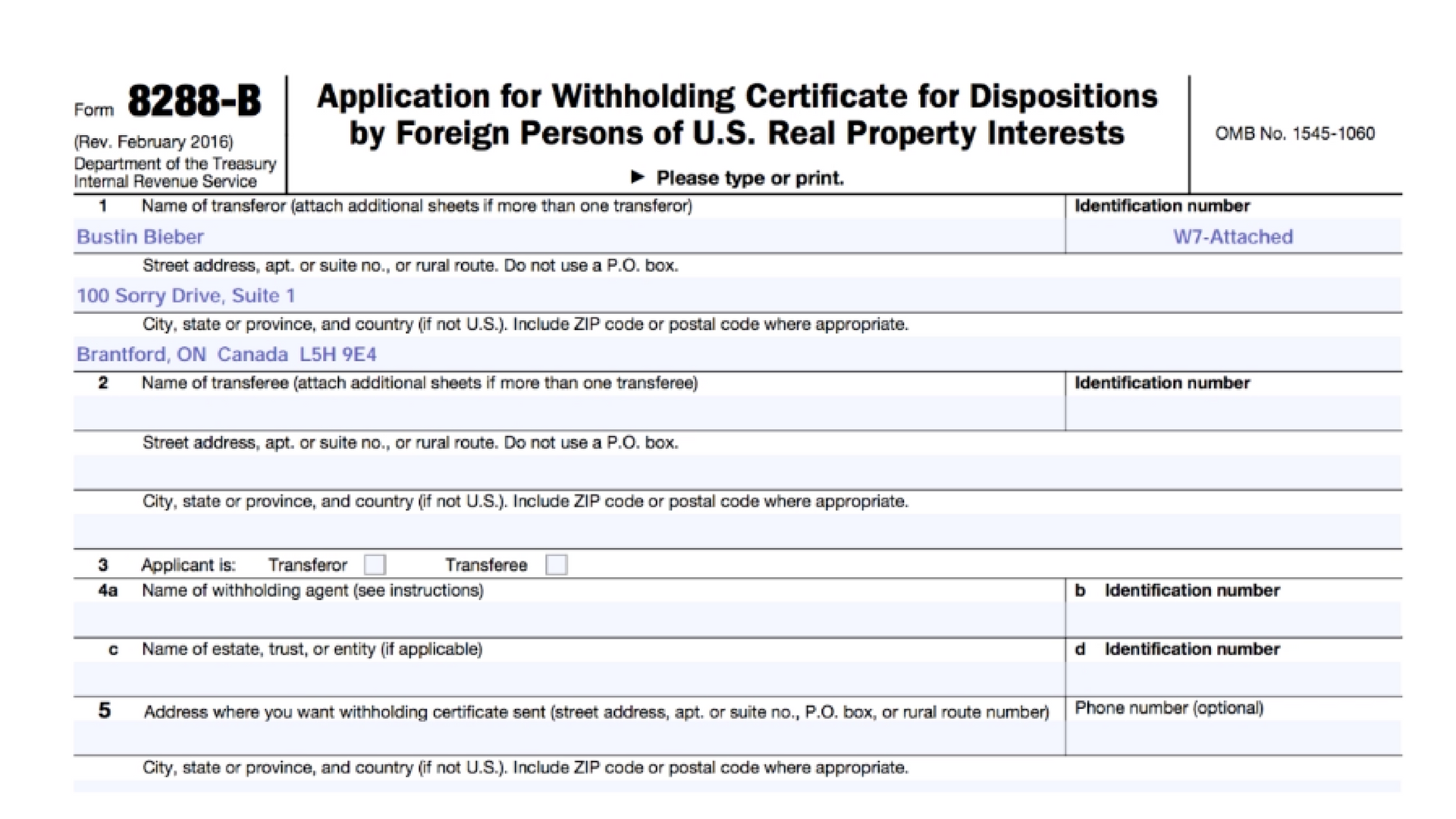

Your spouse gets a job or changes jobs click to expand key takeaways • how much your employer sets aside to pay federal taxes on. This new form offers employees four ways to change their withholdings, depending on how much they work throughout the year: Withholding tax is income tax withheld from employees' wages and paid directly to the government by the employer, and the amount withheld is a credit against.

Use the withholding estimator tool to estimate your tax withholding;. If you’ve gotten a huge tax bill in the past. Interest earned on your savings is classified as earned income by the irs.

Know when to check your withholding; Have a child turning 17. Conducting business in indonesia, like everywhere else, requires.

You get a second job 2. Total up your tax withholding. Line 3 reduces the amount of.

To change your tax withholding you should: There are a number of free paycheck and income tax calculators online. The internal revenue service (irs) provides a free tool to help you calculate.

States and the district of columbia is 42.32 percent as of january 2024,. For those who owe, boosting tax withholding in 2019 is the best way to head off a tax bill next year. See the irs tax withholding for individuals page to: