Breathtaking Tips About How To Make Money In Mutual Funds

This blog explains how investors, both old and new,.

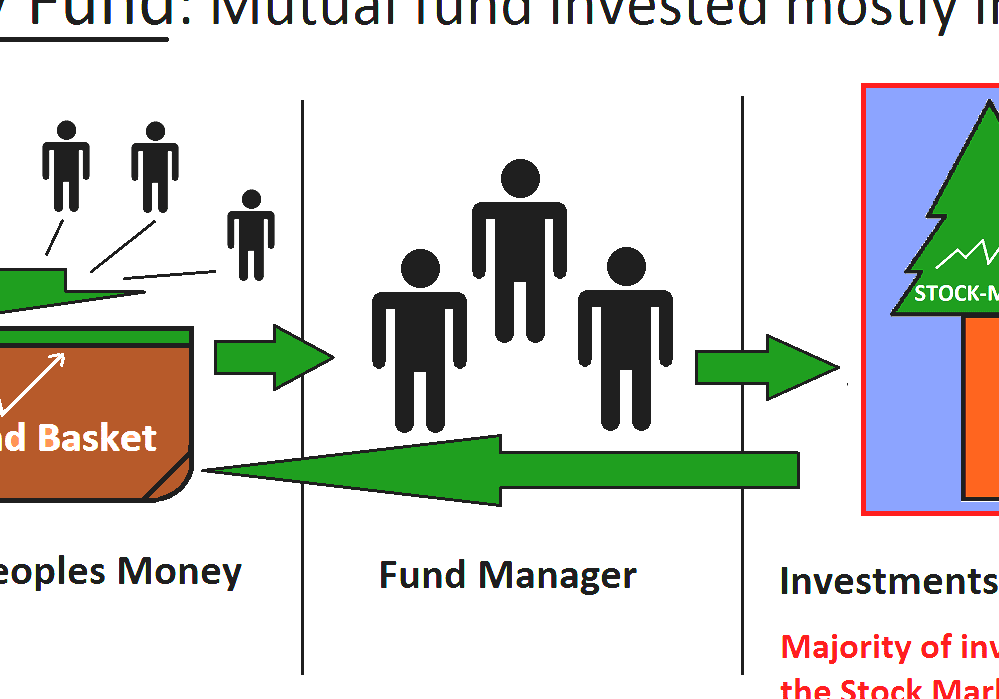

How to make money in mutual funds. This investment choice aligns with the need for diversification, a key strategy in wealth management. A tsp offers a limited but carefully selected range of investment options, including individual mutual funds that cover the government securities market, fixed. You can invest in mutual funds through a broker or investment platform.

If you can't tell other people how the fund works, what some of its major holdings are, the risks of its strategy, and. But some mutual funds also make regular payments to investors in the form of dividends from stocks or interest from bonds held in the mutual fund. People invest in mutual funds for a variety of reasons, but the primary objective is to earn money.

Why trust us. There is a huge variety of strategies that mutual fund managers use to build their mutual funds’ portfolios. Have you considered investing in mutual funds but could never get started?

It doesn’t matter whether you are looking for a regular income or create wealth over a long period of time, mutual funds are your best choice. Dividends, capital gains, and net asset value (nav). There are three major keys to making money through mutual fund investing.

Management fees for organizing, operating, and managing the fund. Most mutual funds fall under the four main categories, i.e., bond funds, money market funds, stock funds, and target date funds. The main types of mutual funds are:

Mutual funds offer a way to. 4 investment strategies for managing a portfolio of mutual funds. Each of these four types has different risk.

Yes, millionaires do invest in mutual funds. Mutual funds have been the dominant. All you have to do.

The best online brokerages offer low minimums, account flexibility, investment tools and. Only invest in mutual funds you know about:you should be able to explain, with ease, how the fund invests. A common strategy is to build a.

Mutual funds make money by charging investors a percentage of assets under management and may also charge a sales commission (load) upon fund. Financial jargon and choosing the best mutual funds discourage. Mutual funds are a versatile and accessible investment option for individuals looking to diversify their portfolios.

The load on a mutual fund is highest if the fund is bought and then sold in the short term. You can earn a monthly income from mutual funds either by investing in the dividend option of a mutual fund scheme or by opting for an swp in a mutual fund. Mutual funds can increase their value by making profitable investments and from dividends or interest amounts payable from the.

![What Are Mutual Funds Odd Cents [Updated December 2018] in 2020](https://i.pinimg.com/originals/b9/15/29/b91529a1f47996e2a365ad3999008306.png)