Exemplary Tips About How To Keep Track Of Your Spending

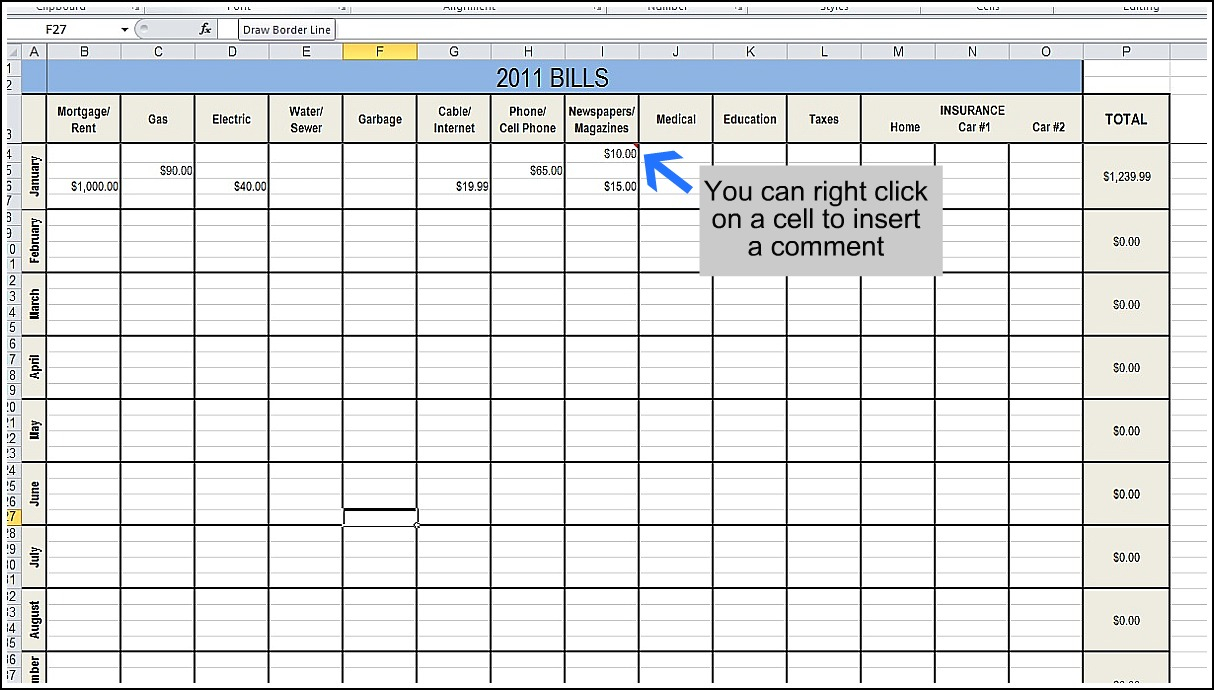

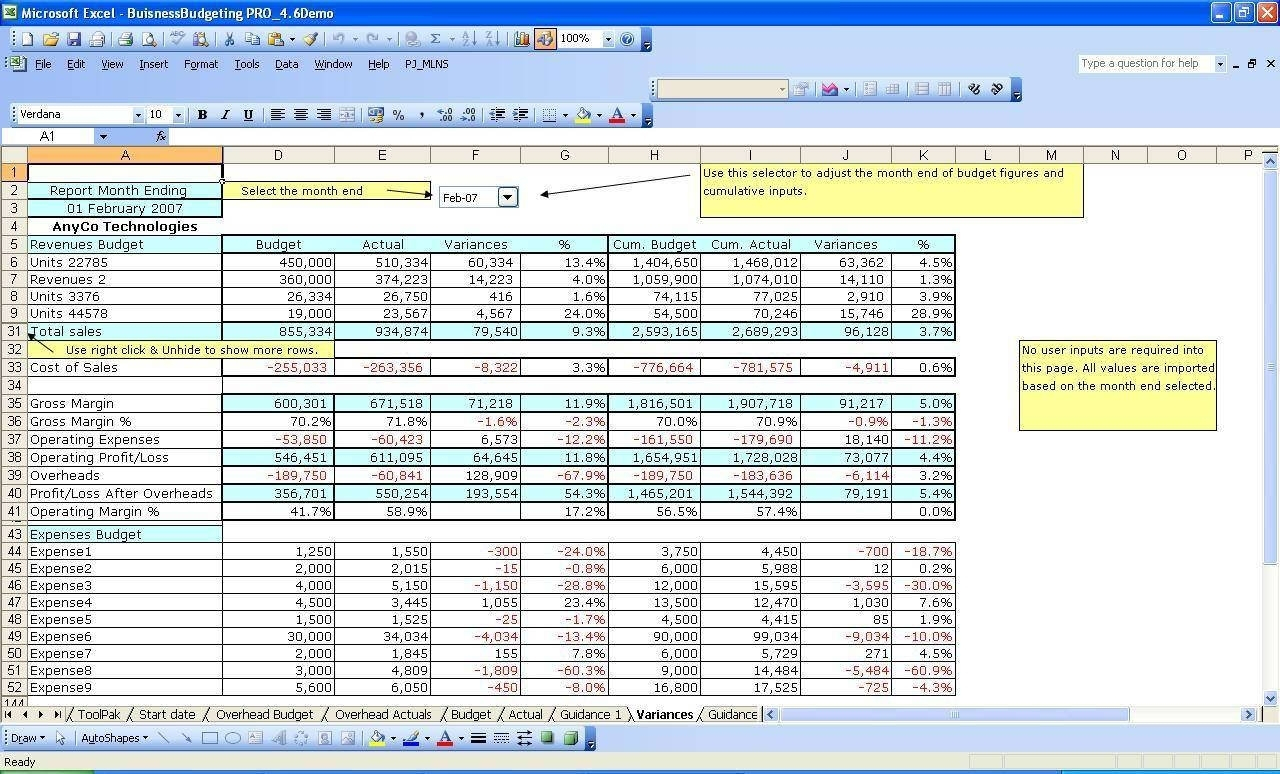

Maximising the use of a single platform keeps both the process and the data as clean as possible.

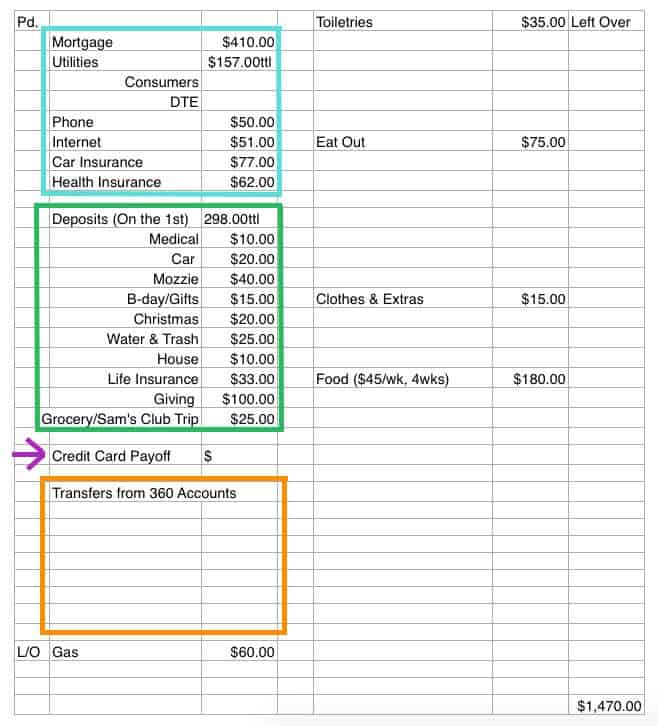

How to keep track of your spending. With a balanced budget, you’re ready to put your spending plan into action. Many beginners track transactions for up to a month before they create a budget. Keep a separate compartment in your purse, wallet, or bag for business paper receipts.

Keep a separate money calendar and put it to work to track your spending. Tracking your expenses (aka tracking your transactions) isn’t hard—it’s a habit. And just like other important habits—you know, like flossing—it takes some.

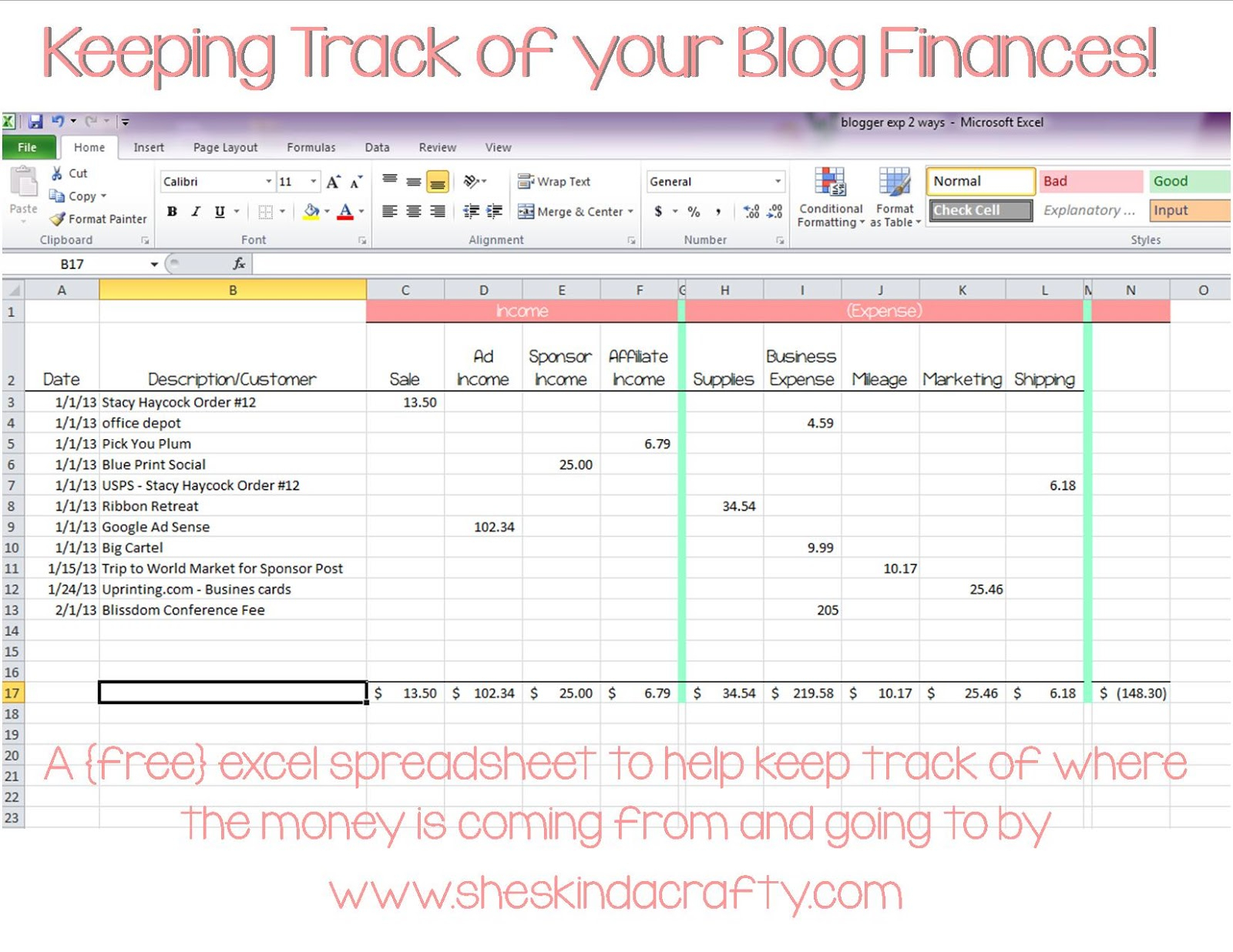

Start spending and saving based on the. How to track business expenses in 5 steps bottom line frequently asked questions (faqs) you can. If you can’t commit to filing your receipts daily, set aside time on a.

Consumer affairs this article is more than 3 years old budgeting apps: Take control of your finances by categorizing monthly expenses properly and knowing the right way to track your spending. Implement and track your spending.

Tracking your spending is often the first step to getting your finances in order. Set aside dedicated time at consistent intervals to assess your financial situation. The best options for tracking your money on the go the lowdown on the pros, cons and fees.

Getty images table of contents what are business expenses? Track as you spend the most active approach: Use a budgeting system or application use envelopes to store your budget for each expense wisely allocate the money you didn’t use spend within your means hold.

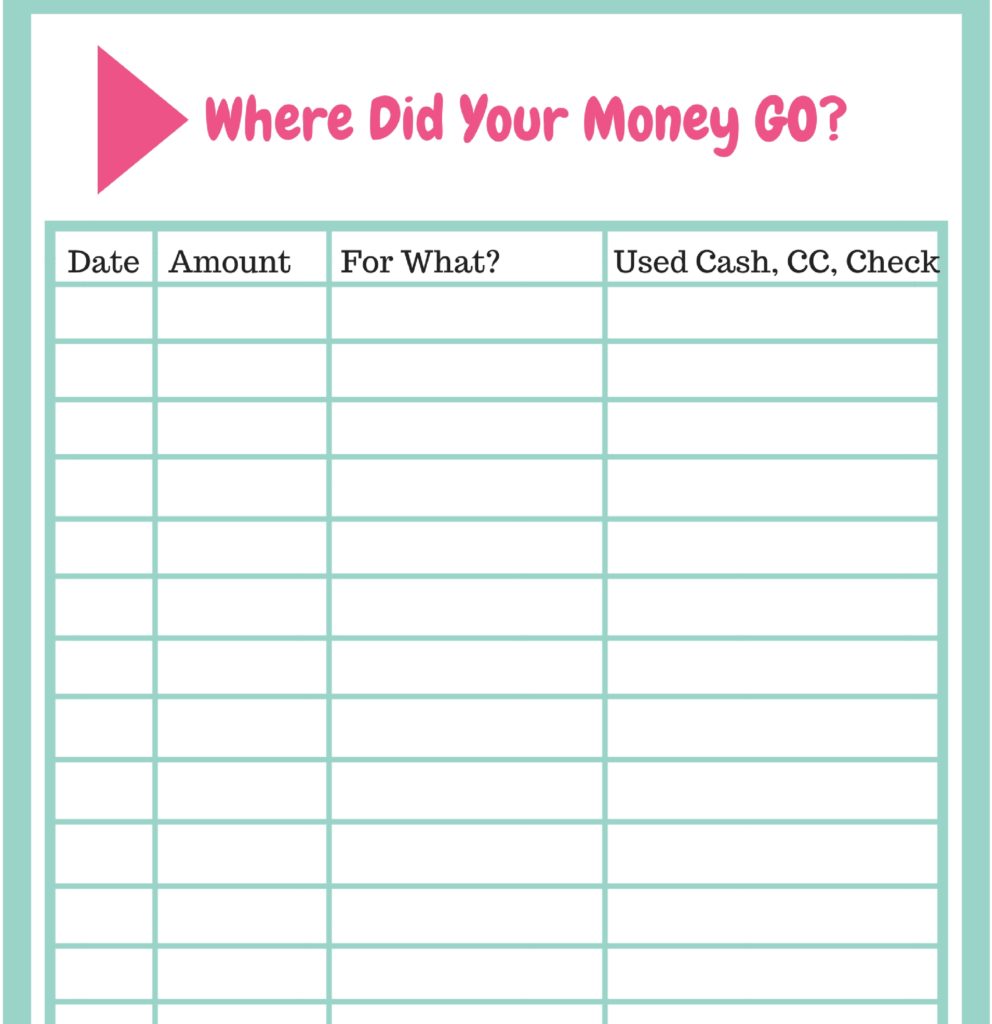

By understanding what you spend money on and just how much things cost, you. Carry around a notebook and pen wherever you go, writing each transaction as you spend. Write down all expenses and income expenses the first step in taking control of your personal.

Here are five pieces of savings and investment advice to strengthen your financial wellness program in 2024. Learn the simple steps here. Ensure the alignment of spending and goals.

Use it to jot down daily, weekly, and monthly expenses as they occur. Founded in 2015, everlance is an app designed to track mileage, expenses, and receipts. How can i keep track of my spending patterns?