Here’s A Quick Way To Solve A Info About How To Get A Low Interest Personal Loan

Lightstream best for excellent credit see at lightstream apr:

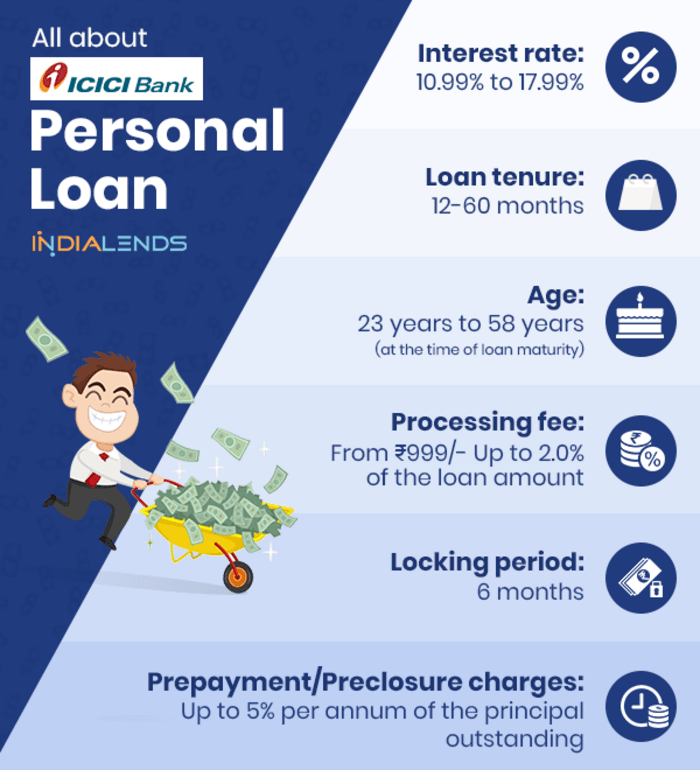

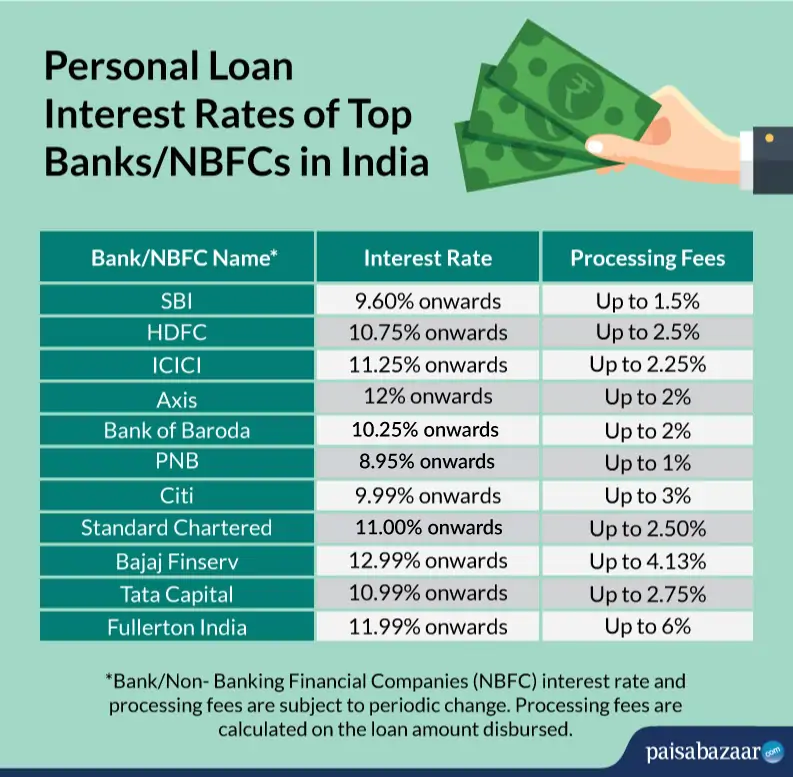

How to get a low interest personal loan. You can get a low interest rate loan where you borrow most financial products. Start out by checking your credit score to assess your financial picture. Current personal loan rates range from around 4% to 36%, with the.

Here’s a look at the best. A good interest rate on a personal loan is one that is lower than the national average. Best low interest personal loans of 2024.

The best low interest personal loans are from lightstream, with aprs starting at 7.49%. How to get a personal loan with low interest rates. Once you've been approved, look over the final loan agreement carefully to make sure you understand your repayment.

Fixed rates from 8.99% apr to 29.99% apr reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. Here are 14 lenders for you sort by best for debt consolidation loans go to lender site on discover check rate on nerdwallet discover 5.0 nerdwallet rating loan term The best way to get a lower interest rate on your personal loan (or any other line of credit) is to improve your credit score before you apply.

A high score gives you a better chance of loan approval and a lower. The company also offers loan. For example, both oportun and upstart offer loans to borrowers with no credit.

With the monthly payment in mind, confirm whether you can. Finding a personal loan with a low interest rate takes a bit of work. Typically, credit unions and online lenders offer the lowest personal loan interest rates.

Find the latest interest rates before. While the lenders listed here have some of. Upstart also sometimes provides the option to secure your loan with a vehicle if you.

Complete the loan and get funded. Where to get a personal loan with a low interest rate.